Should corporate losses be attributed to a shareholder’s income for support purposes? And, how should dividends from a private company be reflected in income?

The recent case of V.O.E. v. L.L.E. 2018 CarswellAlta 2751 (Alta. Q.B.) highlights two important issues in determining income for shareholders of private companies.

- Should corporate losses be attributed to the shareholder?

- How should dividends from a private company be reflected in income?

The jointly-engaged expert, in this case, attributed corporate losses to the father and did not apply a gross-up on dividends received by the father.

The judge, in this case, notes that:

- The purpose of the Guidelines is to determine the actual or effective income available to a payor.

- Section 18 allows the court to look behind closely-controlled corporations to see if there are undistributed funds in the corporation that are available.

- Attributing corporate losses effectively collapses the distinction between corporation and payor as legal entities, which is not the intent of Section 18.

Presumably, the rationale for not attributing corporate losses to a shareholder is that the existence of a corporation protects the shareholder from having to fund losses personally. The Guidelines therefore only address corporate income and ignore corporate losses.

But are there instances where corporate losses should be considered? We think the answer is yes, in the following circumstances:

- Remuneration that is capital, not income. For example, the company paid a $200,000 salary to the shareholder, but incurred a loss of $100,000. Line 150 income is $200,000. But if no salary had been paid, Line 150 income would be $nil, and the company would have earned a profit of $100,000, which might be attributed to the shareholder for Guideline purposes. Clearly, $100,000 is the shareholder’s economic profit for the year. The excess $100,000 of salary paid to the shareholder has come from capital, not income.

- Losses funded by the shareholder. The question of how losses are financed is relevant. In our view, the existence of a corporate structure does not always protect a shareholder from incurring losses personally. We have seen instances where losses have been funded directly by shareholders via shareholder advances, and where external debt is obtained but only with the personal guarantee or postponement of the shareholder.

- Where other companies in a group fund the losses. It is not uncommon for support payors to have interests in more than one private company. It is also not uncommon for the companies to be operationally and/or financially inter-connected, and for some of the companies to generate income while others generate losses. Sometimes profits are moved from one company to another for tax purposes, generating a loss in one company and profits in another. In such instances, it makes economic sense to combine the results of such inter-connected companies together and consider attribution of the net amount. If the net amount of income/losses of the corporate group is a loss, attribution of the net loss should be determined by reference to whether or not the shareholder has personally funded the net loss.

- Averaging of income for prospective purposes. The Guidelines allow for an averaging of income. If a corporation has a history of profitable and non-profitable years, is it fair only to capture profitable years in trying to fix an average income for prospective purposes? If the reason for the losses can be ascribed to events which are not likely to recur in the future, then it makes sense to exclude the losses from the average. But if a company’s performance fluctuates due to general market conditions or cyclicality, then including losses in the average may result in a fairer determination of income.

Dividends from Private Companies

Corporate income can be distributed as dividends, but not all dividends are income! Dividends are just the method and timing of distribution of corporate income and equity, and often have nothing to do with the level of income achieved in a particular year. The timing and quantum of dividends is often driven by the cash flow needs of the shareholder and not necessarily the profit of the business.

Dividends declared in a year can be higher or lower than income achieved. Where dividends are higher than income, the source of the excess amount is capital, not income. For example, if a corporation earned $200,000 in 2018 and declared no dividends, earned $nil in 2019 and issued a dividend of $200,000, the dividend has come from capital (which includes undistributed income of prior years). The obvious danger is that the $200,000 might be attributed to the payor in 2018 and then included in Line 150 income for 2019, resulting in a double-counting of the same income.

In our view, the better approach is to eliminate private company dividends from income, and then assess whether or not the company’s profits for the year are available to the shareholder. This method accurately captures the available income earned in a year, rather than the amount distributed as a dividend.

The payment of dividends is still an important factor to consider as part of a corporate income attribution analysis. For example, if a dividend was paid, it is relevant in assessing the availability of income, but not in determining the amount of income. For example, if income for the year is $100,000 and a dividend of $200,000 was paid in the year to the shareholder, then it is obvious that the $100,000 of income was available to the shareholder and should be included in income.

Should Private Company Dividends Be Grossed-Up?

If the intent of a gross-up is to capture the benefit of a lower tax rate applicable to dividends (versus salary or bonus), then the answer is no, as shareholders of private companies eventually end up paying tax on company profits at the higher rate.

All accountants are aware of the concept of “integration” – the mechanics of the Income Tax Act under which corporate profits are taxed at approximately the same rates on employment income no matter if paid as salary, bonus or dividends. Integration is not perfect and there might be some leakage, but a gross-up using standard tax rates for dividends and employment income grossly overstates the benefit, if any.

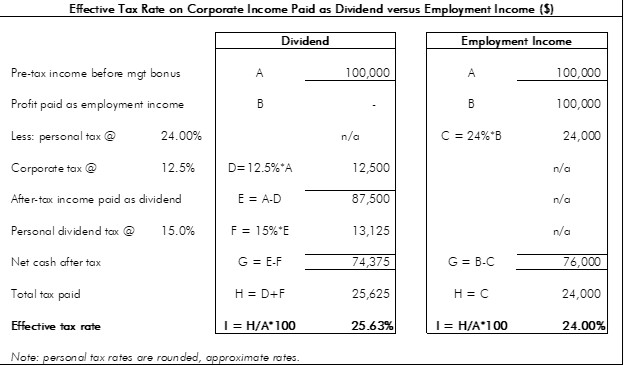

The following examples illustrate the point (i.e. the effective tax rate on employment income is 24% versus 25.63% on combined corporate tax and personal tax on dividends):

We acknowledge that the case of V.O.E. v. L.L.E. 2018 CarswellAlta 2751 (Alta. Q.B.) referred to above was successfully appealed. We are of the view that our position on the circumstances in which losses should be considered as part of a support payors’ income as described herein are still applicable.

This article was written by Paula G. White